Superannuation & SMSF

advice you can trust

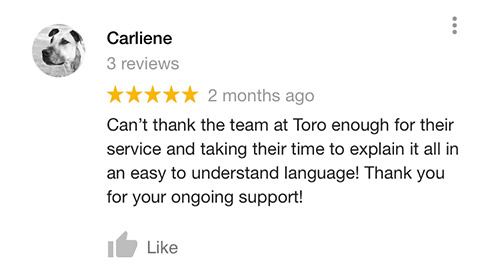

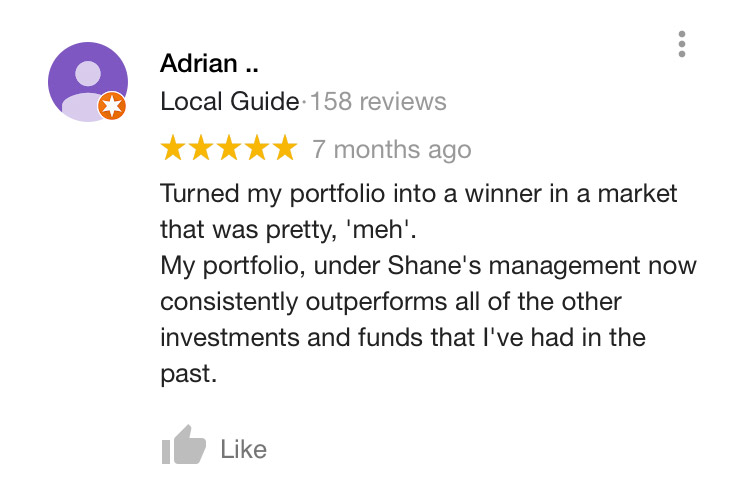

Secure your financial future sooner with expert superannuation advice.

HOW WE CAN HELP YOU WITH SUPERANNUATION

Set-up a tax-effective super contribution strategy.

Determine how much (if any) of your personal investments should be moved into super and cap your tax at 15%.

Minimise the impact of fees on your super.

Provide low-cost investment options.

Get 24/7 online access to your account and investments.

WHY GET SUPERANNUATION ADVICE?

Putting in place effective superannuation contribution strategies and ensuring your superannuation balance is invested in a way designed to produce returns to help meet your retirement objectives.

Seeking advice is an essential starting point for getting your super on track, so that you can know exactly when you can retire and how much you will have for retirement.

Ready to grow your superannuation?

Speak to an adviser

FREQUENTLY ASKED QUESTIONS

What are the benefits of superannuation?

Superannuation is an incentivised savings initiative designed to help Australians fund their retirement.

Contributions are made into a superannuation account by you or your employer. These contributions are then invested with all earnings taxed at a concessional rate. At or near retirement, these funds can be drawn upon to assist in covering your personal lifestyle expenses.

The benefit of investing in superannuation is that all earnings received from investments within your account are taxed at a maximum of 15%, which may be lower than your personal tax rate if you were to invest in your own name. Certain contributions made to superannuation can also reduce your personal income tax obligations each year.

What is a superannuation fund?

A superannuation fund is an account run by a superannuation fund trustee. The trustee is responsible for maintaining a compliant superannuation fund for members.

A superannuation fund allows you to join as a member, providing you with the ability to contribute to your superannuation fund account, or have contributions made on your behalf from an employer.

Each superannuation fund has their own set of rules within the scope of the legislation. The superannuation fund will provide its members with an investment menu to choose from as well as personal life insurance solutions. Superannuation fund fees can vary greatly between superannuation funds and are set by the trustee of the fund.

Who is eligible for superannuation?

Everyone who is over age 18 and earns at least $450 per month (before tax) is eligible to receive superannuation guarantee (SG) contributions from their employer.

SG contributions are paid quarterly by an employer into an employee’s superannuation account. The general amount paid is equal to a rate of 9.5% of the employees’ salary. However, this amount may be different depending on your employment agreement.

Your employer will need to notify you of their employer-nominated fund, which is where they will make contributions into on your behalf. In many cases, an employee has the right to choose an alternative fund for their contributions to be paid into.

Putting in place a retirement plan can begin as soon as you like. Starting earlier will provide a more probable outcome.

Ultimately, having the ability to retire at your chosen time with your desired retirement income is everyone’s goal. Working with an adviser will help structure a personalised retirement plan that you are comfortable with. This is done through adopting suitable investment strategies, capitalising on contribution caps and optimising the tax-effectiveness of your transition to retirement strategy.

Should I compare my superannuation?

With dozens of superannuation funds available, it can be a good idea to compare which fund best suits your needs, based on fees, performance, features and functionality.

The best performing superannuation fund may change from year to year. The investment option/s within your super account will also impact the performance of your super portfolio. Therefore, not only is it important to compare super funds, it is equally important to compare various investment options within those super funds.

When choosing one or more investment options within your account, you should understand the risks associated. A Product Disclosure Statement (PDS) is provided by each super fund and gives an overview of the types of investments available and the costs associated.

Book your obligation free consultation today

Simply leave us a message below and we will be in touch shortly.